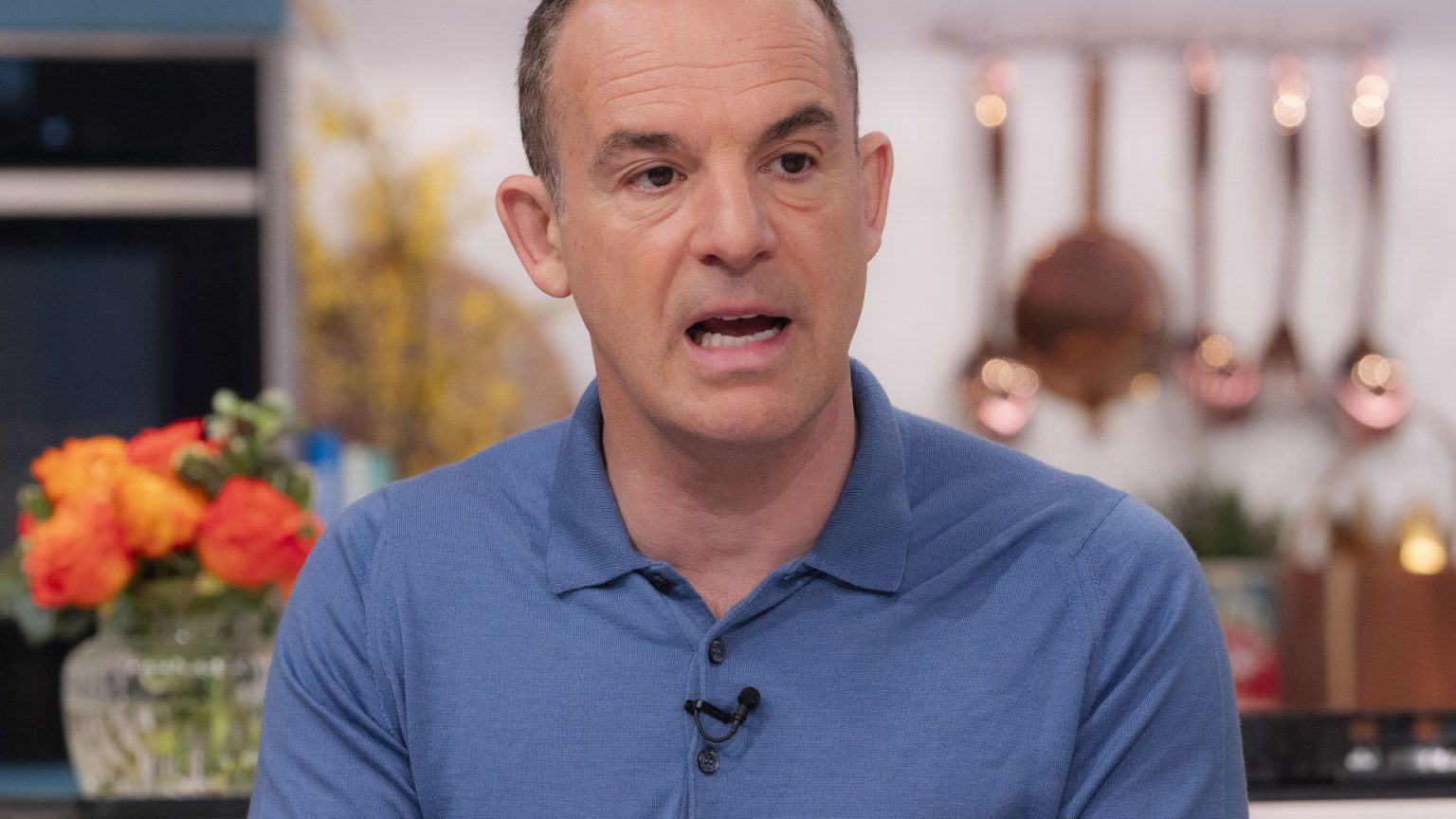

Drivers can significantly reduce their annual car insurance costs by employing several strategies. The average annual car insurance premium is around £834, but utilizing tools like the Compare+ Car Insurance tool from Martin Lewis’ MoneySavingExpert website can help find better deals. This tool compares prices from various insurers, including those on MoneySuperMarket.com, and provides tips on lowering premiums, such as adding a responsible additional driver. It’s crucial to compare quotes from multiple comparison websites and directly from insurers like Direct Line to ensure securing the most competitive price and appropriate coverage. Careful review of policy details and customer service ratings is also vital to avoid future claim issues.

One of the most effective ways to save on car insurance is paying the annual premium upfront rather than opting for monthly instalments. While monthly payments offer convenience, they often include interest charges, adding approximately 10% to the overall cost. Paying annually can save an average motorist around £225. If a lump-sum payment is unaffordable, using a 0% purchase credit card can help avoid interest charges, provided the balance is paid before the introductory period expires.

Another significant factor influencing premiums is mileage. High-mileage drivers (over 20,000 miles annually) face higher premiums due to increased risk. Optimizing mileage and accurately reporting it to insurers can lead to substantial savings. Interestingly, drivers covering 12,000-13,999 miles annually often enjoy the lowest premiums. Accurately reporting mileage is essential, as insurers calculate premiums based on perceived risk.

Adding an experienced older driver, especially for young or newly qualified drivers, can dramatically reduce premiums. Younger drivers statistically represent a higher risk, resulting in higher insurance costs. Including an older driver with a good driving record can significantly lower the premium, potentially saving hundreds of pounds annually. However, it’s crucial that all named drivers genuinely use the car to avoid “fronting,” an illegal practice where someone falsely claims to be the main driver.

Building a no-claims discount is a powerful long-term strategy for lowering premiums. Each claim-free year earns a discount, which can significantly reduce the cost of insurance. Discounts can reach up to 60% for five claim-free years, saving drivers substantial amounts annually. Maintaining a clean driving record is therefore financially rewarding in the long run.

The excess, the amount paid out-of-pocket when making a claim, also plays a role in premium costs. Opting for a higher voluntary excess can lower premiums, but it’s crucial to choose an amount that can be comfortably afforded in the event of a claim. Balancing premium savings with affordability is key when setting the excess. Accurately representing job titles can also impact premiums. While certain professions are considered higher risk, ensuring accurate and specific job descriptions can avoid unnecessary premium increases.

Besides these core strategies, other methods can help reduce car insurance costs. Shopping around on comparison websites and checking directly with insurers like Direct Line is essential for finding the best deals. Renewing insurance well in advance of the renewal date can also save money, as prices tend to increase closer to the expiration date. Utilizing cashback websites can offer further savings. Understanding these factors and implementing appropriate strategies can empower drivers to control their car insurance costs and secure the best possible deals.

Car insurance is a legal requirement, providing financial protection against theft, damage, fire, and accidents. It covers damage caused to third parties, their property, and vehicles. Claims are typically made when an accident is the driver’s fault; otherwise, the other party’s insurance covers the costs. Driving without insurance carries hefty fines, license penalties, and even vehicle seizure. However, cars declared “off-road” and kept on private land do not require insurance. Understanding the purpose and requirements of car insurance is essential for all drivers.

In summary, managing car insurance costs effectively involves a combination of proactive strategies. These include paying annually, optimizing mileage, adding experienced drivers, building a no-claims discount, choosing an appropriate excess, accurately representing job title, shopping around for the best deals, renewing in advance, and utilizing cashback websites. By understanding these factors and implementing tailored strategies, drivers can significantly reduce their annual insurance expenditure and ensure adequate coverage.