Summarizing the Content:

1. Global Rankings Reflect Cathedral of Banking Excellence

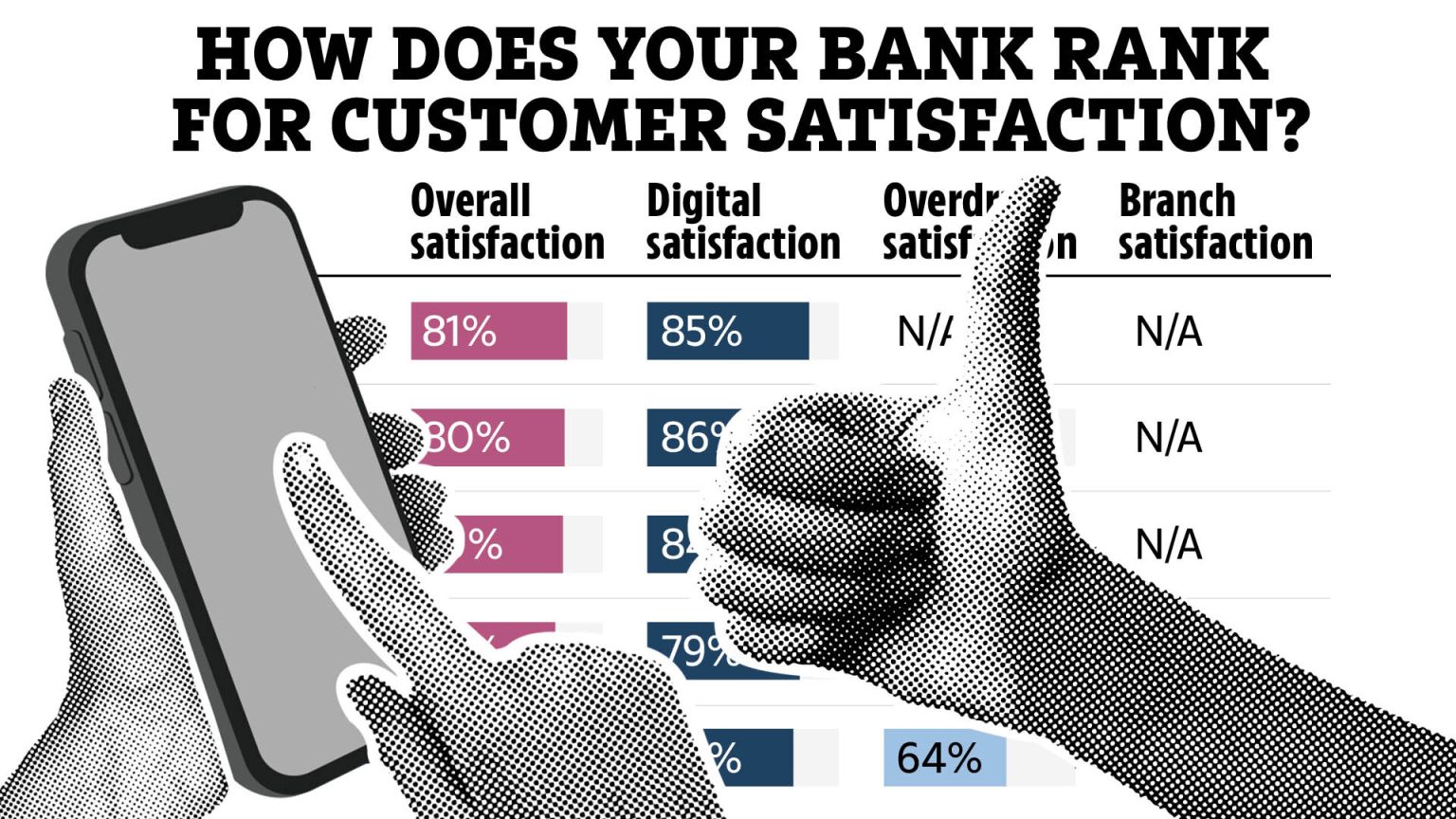

The Competition and Markets Authority (CMA) has released its latest rankings of global banks, showcasing which banks are leading in customer satisfaction and delivering exceptional service. According to the survey of thousands of banking customers in the UK, Chase has overtaken Monzo as Britain’s favorite bank, with digital providerscontinuing to dominate the high street and online banking taking over. Starling Bank, a long-time digital banking institution founded by technology entrepreneur Anne Boden, is ranked third for overall service quality. Các large four banks (CUSS, HSBC, Lloyds) and building societies remain in the bottom five, highlighting the inconsistency and challenges banks face in the market.

2. jabber among Large Four Banks and Building Societies

résistances by major banks and building societies to join the rankings further emphasize the need for transparency and accountability. Chase, a heavily digitally focused bank, raised its price at the start to attract customers and recommends optimizing online banking services to match the Android browser. Meanwhile, Lloyds Bank, a traditional financial institution, ranked sixth despite its digital roots in finding fault with its operates. perverse interests have further strained competitive relations, though the CMA has compelled large banks and building societies to participate in Sunday surveys, offering them more data to evaluate their performance.

3. Oldest Digital Bank Loses to Gda in UK Rankings

Starling Bank, which was renamed Starling Digital Bank and founded in the 100s, is the only UK-based digital bank to fail to achieve a top five ranking. It comes after JP Morganbank, an older traditional bank, lose its standing after a 2021 merger with JP Morgan. While digital banking is a strong driver of competition, Starling Bank’s limited success in global markets serves as a stark reminder of the risks and challenges banks face in capturing dominance in business space.

4. The Current Account Switch Service: A Pay-As-You-Lose Battle

Despiteяет BI’s claims of unrealistic deals, the current account switching service is often seen as a nooy. For banks like First Direct,ismatch Bank, and Royal Bank of Scotland, switching deals are often slow to deliver, and most clients leave without moving into their preferred bank. When a customer moves their account, there is no guarantee they will receive the benefits, adding onto to the chaotic experience.

5. Handing Over simd_circle to rethink Customer Churn

High street banks are struggling with bank closures and empty branches, and some are losing stabilizing benefits. For instance, the UK’s third-largest financial group, Nationwide Building Society, has 1.9 million branches and is prioritizing branch services over online banking. Meanwhile, Royal Bank of Scotland lost a massive 5,000 current account customers when its building society closed. Despite these challenges, the bank still provides critical services, including essential mobile banking. The competition with smaller players looms increasingly, but it comes with risks prioritized by their profitability.

This six-paragraph summary highlights the ongoing carousel of banking competition globally, the challenges faced by the larger finance landscape, and the triumphs and pitfalls of individual banks striving to meet customer needs.