Severn Trent Water, a prominent water company serving millions across central England and mid-Wales, has come under scrutiny for its accounting practices, specifically regarding a complex financial arrangement involving a shell company called Severn Trent Trimpley. This arrangement, highlighted by a BBC Panorama investigation, involves the creation of an asset valued at over £1 billion on Severn Trent Water’s balance sheet, despite allegedly having no real-world value. This inflated asset has raised concerns about the company’s true financial health and the potential impact on customer bills and environmental investments.

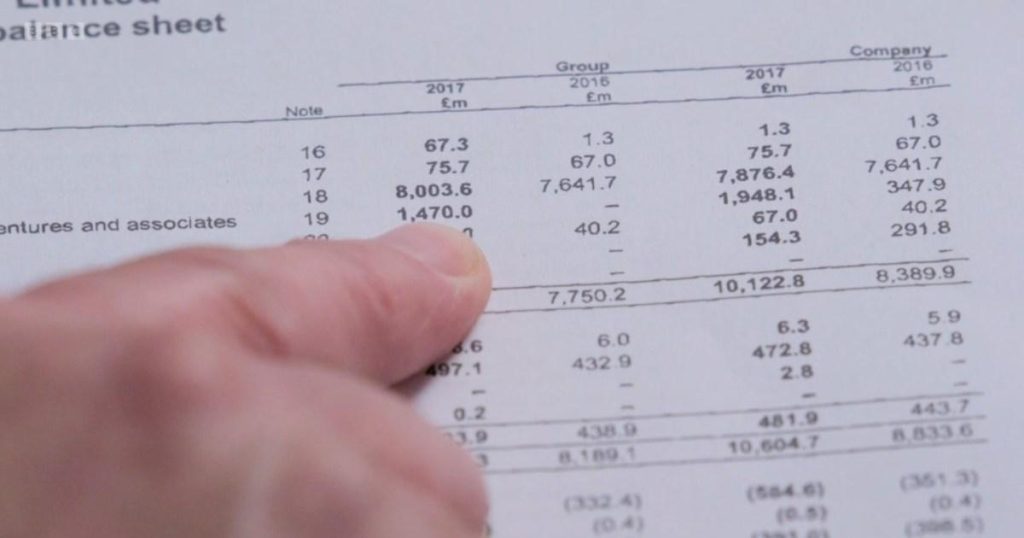

The controversy centers around the creation of Trimpley, a shell company with no initial assets or operations. Severn Trent Draycote, another company within the Severn Trent group and the owner of the water company, acquired Trimpley for a nominal sum and subsequently invested £3 billion in it. However, this “investment” was not a cash transaction but rather a loan note, essentially an IOU. Despite representing a debt rather than a tangible asset, this IOU inflated Trimpley’s value on paper. Severn Trent Water then acquired a portion of Trimpley, booking this investment at a substantial value on its own balance sheet.

This accounting maneuver, while seemingly complex, effectively allows Severn Trent Water to recognize future earnings upfront, boosting its apparent financial strength. Critics, including retired auditor Stanley Root, argue that this practice misrepresents the company’s actual financial position, making it appear healthier than it is. Furthermore, concerns have been raised about the potential impact on customers, with some arguing that this financial maneuvering prioritizes shareholder payouts over necessary investments in infrastructure and environmental protection.

The timing of this financial arrangement coinciding with significant dividend payouts to Severn Trent shareholders has fueled further suspicion. Since the Trimpley investment was recorded, Severn Trent Water has paid out dividends exceeding its reported profits. While the company denies any link between the Trimpley arrangement and dividend payments, maintaining that all dividends are justified by earnings, critics argue that the inflated asset base allows the company to distribute more to shareholders than would otherwise be possible. This has led to accusations that the company is prioritizing shareholder enrichment over reinvestment in critical infrastructure upgrades and environmental remediation efforts.

Severn Trent vehemently defends its accounting practices, asserting that the Trimpley structure is entirely legitimate, legal, and transparent. The company emphasizes that its accounts are independently audited and that any suggestion of misleading investors, regulators, or customers is false. It contends that the IOU is a real asset backed by other group companies and that its overall financial health is strong, pointing to a recent successful fundraising effort and commitments to record investments in infrastructure. Ofwat, the water industry regulator, has stated that it has not received any reports of regulatory breaches related to this issue.

Despite Severn Trent’s assurances, the controversy surrounding the Trimpley arrangement highlights broader concerns about the financial practices of water companies and their impact on customers and the environment. Campaign groups like Up Sewage Creek argue that companies should prioritize investments in infrastructure and pollution control over shareholder returns. The debate over Severn Trent’s accounting practices underscores the need for greater transparency and scrutiny of water companies’ finances to ensure that they are acting in the best interests of their customers and the environment they serve. This issue also raises questions about the adequacy of current regulatory frameworks in overseeing complex financial arrangements and preventing potential manipulations that could ultimately impact customer bills and environmental protection.