The Evolution of the Wetherspoons Pub Empire: A Balancing Act of Closures and Expansion

JD Wetherspoons, the ubiquitous UK pub chain known for its affordable drinks and meals, is navigating a complex landscape of closures, expansions, and strategic shifts in its business model. While the company has seen a net reduction in its pub count over the past decade, dropping from around 950 to approximately 800, it remains committed to growth, aiming to reach a portfolio of 1,000 pubs in the future. This ambition is underscored by a dual strategy: streamlining operations by shedding less profitable venues and simultaneously investing in new locations and expanding existing ones. The company’s recent financial performance demonstrates the effectiveness of this approach, with overall sales increasing despite a decrease in the number of operating pubs.

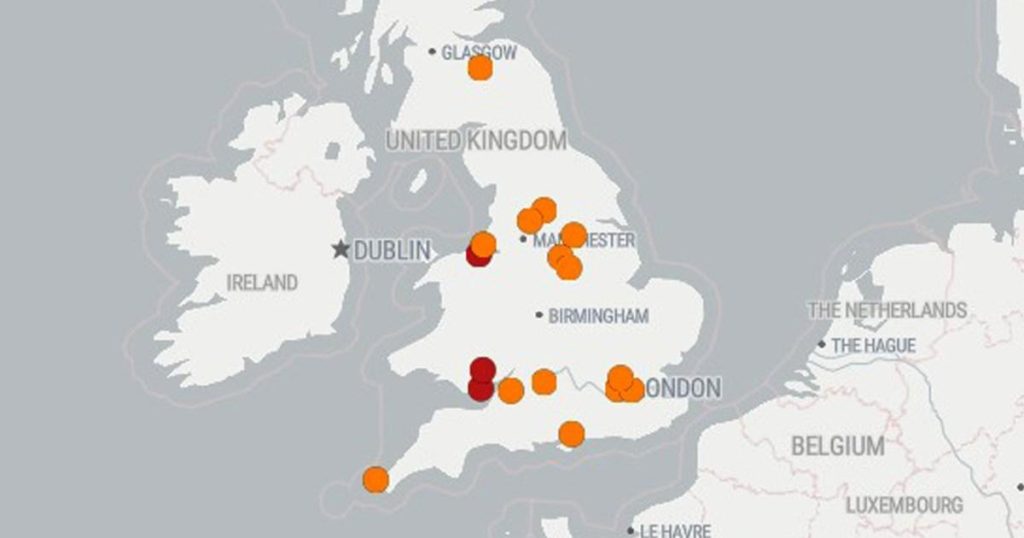

The recent closures, totaling 26 since July 2023, are part of an ongoing rationalization process. Wetherspoons has been strategically divesting itself of smaller, older pubs, particularly those situated in close proximity to other Wetherspoons establishments. This streamlining aims to optimize profitability by focusing on larger, more modern, and strategically located venues. The closure list includes pubs like The Hain Line in Cornwall, Foot of the Walk in Leith, and The Linen Weaver in Cork. While some closed pubs, like The George in Wanstead, have been taken over by other pub chains, the majority are likely to be repurposed for different commercial uses or remain vacant.

Despite the closures, Wetherspoons remains optimistic about its future, fueled by a reported sales growth of nearly 8% in the year leading up to July 2024. This positive trend, coupled with easing inflation, has encouraged the company to pursue an expansionist strategy. Wetherspoons has identified potential sites in 130 towns and cities across the UK, signaling a commitment to expanding its reach. Recent openings include the Captain Flinders near Euston Station, The Lion and Unicorn at Waterloo Station, the Star Light at Heathrow Airport, The Grand Assembly in Marlow, and the Scribbling Mill in Leeds. These new additions reflect a strategic focus on high-traffic locations, including transportation hubs and shopping centers.

In addition to opening new pubs, Wetherspoons is investing in the expansion and refurbishment of existing sites. This includes venues like the Red Lion in Skegness, the Talk of the Town in Paignton, the Albany Palace in Trowbridge, and the Mile Castle in Newcastle. These upgrades aim to enhance the customer experience and attract new clientele, further boosting sales and profitability. This two-pronged approach of expansion and renovation demonstrates Wetherspoons’ commitment to long-term growth and its confidence in the enduring appeal of the traditional pub experience.

Central to Wetherspoons’ business model is its commitment to affordability. Despite rising costs across the hospitality sector, the chain has maintained its competitive pricing strategy, exemplified by its steadfast refusal to increase the price of its popular £5.75 breakfast. This commitment to value resonates with customers, particularly during times of economic uncertainty. Chairman Tim Martin has publicly stated his intention to hold prices steady, further solidifying Wetherspoons’ reputation as a budget-friendly option for dining and drinking.

The company’s long-term strategy involves increasing its ownership of freehold properties. Currently, around 71% of Wetherspoons pubs are freehold, a significant increase from 41% in 2010. This shift towards freehold ownership provides greater control over operations and reduces reliance on lease agreements, strengthening the company’s financial position. This strategic move underscores Wetherspoons’ commitment to long-term stability and its confidence in its future prospects. The transition to freehold ownership not only reduces operational costs but also provides greater flexibility in adapting to changing market conditions.

While two pubs, the Ivor Davies in Cardiff and The Quay in Poole, are currently under offer for sale, their future remains uncertain. The sales could fall through, allowing these pubs to continue operating under the Wetherspoons banner. This uncertainty highlights the dynamic nature of the pub industry and the ongoing adjustments Wetherspoons is making to optimize its portfolio. The company regularly reviews its holdings and adjusts its strategy based on market conditions and individual pub performance. This adaptability is crucial in navigating the challenges and opportunities of the evolving hospitality landscape.

Wetherspoons’ journey is a testament to the ongoing evolution of the UK pub industry. The company’s strategic decisions reflect a delicate balancing act: streamlining operations through closures while simultaneously pursuing ambitious expansion plans. By focusing on profitability, strategic locations, and customer value, Wetherspoons aims to secure its position as a leading player in the UK pub market. This ongoing transformation underscores the company’s commitment to adapting to changing consumer preferences and market dynamics, ensuring its long-term viability in a competitive landscape.