In the UK, pensioners receive an average of 54.4% of their previous earnings as a worker, which is lower compared to many European countries. Countries like Portugal have pensioners receiving close to 100% of their previous earnings, with the EU average being 68.1%. This issue has raised concerns about the adequacy of pensions in the UK compared to other nations. Chancellor Rachel Reeves recently announced a 4.1% increase in the state pension for the next financial year, benefiting over 12 million pensioners with up to £470 extra per year. This increase aims to address some of the financial challenges faced by pensioners as a result of cuts to the Winter Fuel Allowance.

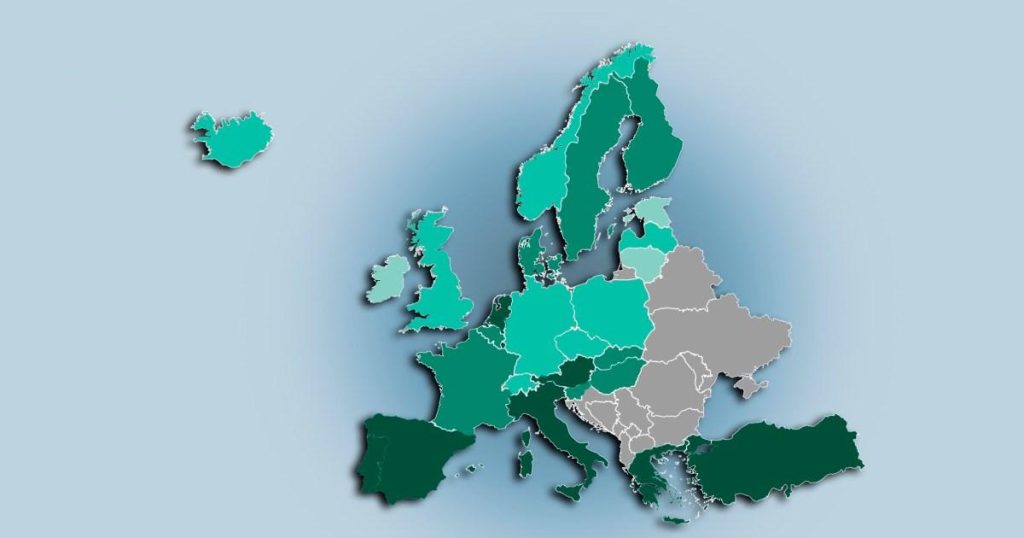

The OECD’s statistics highlight that the UK’s pension ‘replacement rate’ is similar to that of Norway and Germany, while countries like Turkey, the Netherlands, and Greece offer pensioners 90% or more of their previous earnings. On the other hand, countries like Lithuania, Estonia, and Ireland have some of the lowest pension rates in Europe when excluding voluntary pension schemes. In the UK, pensioners receive either the Old State Pension or the New State Pension depending on when they reached the eligible age. The Old State Pension is a two-tier system with a flat rate, while the New State Pension is a single-tier flat-rate allowance. Both pensions are adjusted annually through the triple lock system to ensure increases in line with 2.5%, inflation, or earnings growth.

The recent Budget announcement included changes regarding unused pension funds being included within a person’s estate for Inheritance Tax purposes. This move by the Treasury aims to boost revenues from this source, potentially affecting individuals’ estate planning strategies. With the evolving landscape of pensions and retirement planning, it is important for individuals to stay informed about these policy changes that may impact their financial security in retirement. The UK government’s efforts to address pension adequacy through the triple lock system and increases in the state pension reflect ongoing discussions about the sustainability and fairness of pension schemes.

As the cost of living continues to rise and economic challenges persist, the issue of pension adequacy remains a critical concern for individuals approaching retirement age. Ensuring that pension schemes provide sufficient financial support to retirees is essential for promoting financial stability and well-being in later years. By comparing the UK’s pension system to those of other European countries, policymakers and stakeholders can identify areas for improvement and implement strategies to enhance the overall effectiveness and fairness of pension provisions. It is crucial to address disparities in pension replacement rates and explore opportunities to strengthen the pension system to meet the needs of an aging population.

The future of pension policies in the UK will likely involve ongoing debates and reforms to ensure the sustainability and adequacy of pension benefits for retirees. By examining international best practices and considering the experiences of other countries, the UK can make informed decisions to enhance its pension system and address the evolving needs of pensioners. As the government continues to make changes to pension regulations and taxation policies, it is important for individuals to seek advice from financial experts and plan effectively for their retirement years. Ultimately, a robust and equitable pension system is vital for promoting financial security and well-being among older adults in the UK.