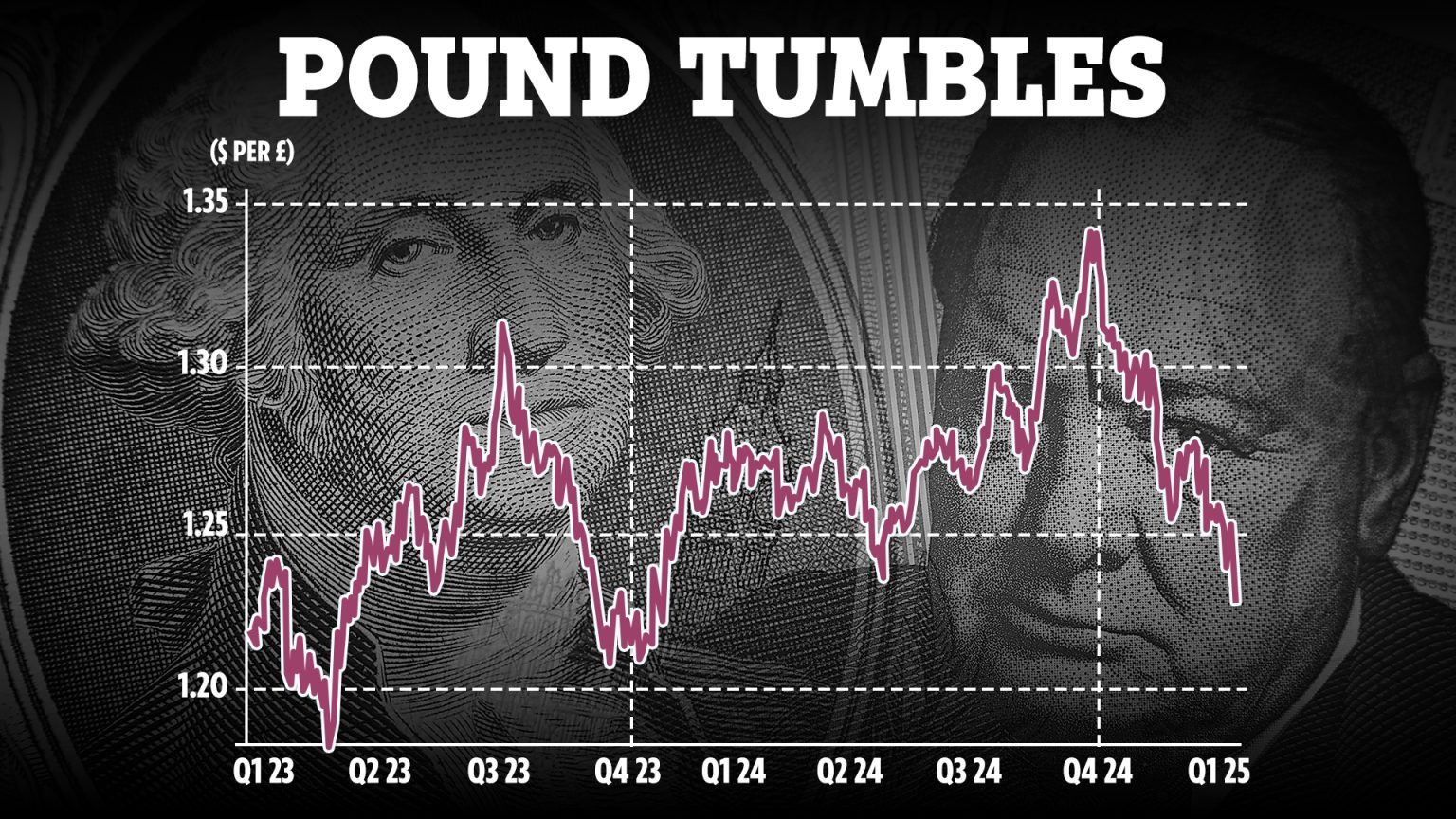

The British pound has plummeted to its lowest value against the US dollar since November 2023, triggered by a sharp surge in UK government borrowing costs, which recently hit a 27-year high. This decline signifies that £1 now buys less than $1.23, a troubling development for holidaymakers who will receive fewer dollars for their pounds at foreign exchange bureaus. This depreciation directly impacts travel budgets, making overseas purchases more expensive and potentially limiting holiday activities. The root cause of the pound’s decline lies in the escalating cost of government borrowing.

The rising cost of government borrowing is reflected in the increasing yields on government bonds, also known as gilts. These bonds are essentially loans to the government, and the yield represents the interest rate the government pays on these loans. The yield on 10-year gilts, a benchmark for setting mortgage rates and other borrowing costs, has climbed to its highest level since August 2023, while the 30-year gilt yield has reached its highest point since 1998. Typically, higher yields would attract investors, leading them to buy pounds to purchase these bonds, which would in turn increase the pound’s value. However, the current scenario is different. The rising yields are stoking investor concerns about the UK economy, sparking fears of potential financial struggles for the government and a looming period of “stagflation” – characterized by slow economic growth and high inflation.

Instead of attracting investment, the rising yields are creating an environment of uncertainty, making the UK a less attractive investment destination. This has resulted in investors selling pounds rather than buying them, further driving down the pound’s value. This echoes the market reaction to the mini-budget presented by Liz Truss in 2022, which similarly spooked investors and triggered a sharp drop in the pound. The current situation underscores a lack of confidence in the government’s economic policies and their potential impact on the UK’s financial stability.

Gilts, essentially government IOUs, serve as a barometer of global investor sentiment toward the UK economy and its leadership. They are debt instruments issued by the government with a fixed term and a promised return, or coupon, paid to investors. The yield on these bonds reflects the interest paid and rises when the bond price falls, compensating investors for the increased risk of holding a cheaper asset. The current surge in gilt yields indicates growing concerns about the UK’s economic health and the government’s fiscal policies. Economists are now warning that Chancellor Rachel Reeves may need to resort to tax increases or spending cuts to address widening fiscal imbalances. The rising cost of servicing government debt is further constraining public finances, amplifying worries about the nation’s long-term fiscal stability.

The implications of the falling pound are far-reaching. For individuals, it translates to less buying power abroad, affecting everything from holiday spending to the cost of imported goods. The declining pound can also impact the value of pensions and investments, particularly those tied to overseas assets. This is because the value of foreign holdings is calculated in their respective currencies and then converted back to pounds, so a weaker pound reduces their value in sterling terms. Although the rapid sell-off of government bonds has moderated somewhat, the pound’s continued weakness reflects persistent market anxiety. Despite a slight easing in the bond sell-off, the pound’s response indicates ongoing concerns about the UK’s fiscal position, described as “perilous.” Expectations are that the Chancellor will focus on public spending cuts rather than further tax hikes to meet fiscal targets, but market skepticism remains high.

The current economic predicament underscores the challenging balance the government faces. The Chancellor needs to address rising debt interest costs while adhering to fiscal rules, which might necessitate further spending cuts or increased revenue. The commitment to a single annual fiscal event limits options and raises anticipation for the upcoming March fiscal statement.

High inflation rates, exceeding the Bank of England’s 2% target, could further complicate matters by deterring interest rate reductions in the near future. This could negatively impact mortgage holders hoping for lower rates when they remortgage. Inflation, a measure of the rising cost of goods and services, erodes purchasing power and impacts savings. While high inflation is problematic, excessively low inflation can also be harmful, potentially discouraging spending and hindering economic growth. The current economic climate presents complex challenges for both the government and individual consumers, highlighting the interconnectedness of global markets, government policy, and personal finances.