The Impact of Marital Status on Car Insurance Premiums

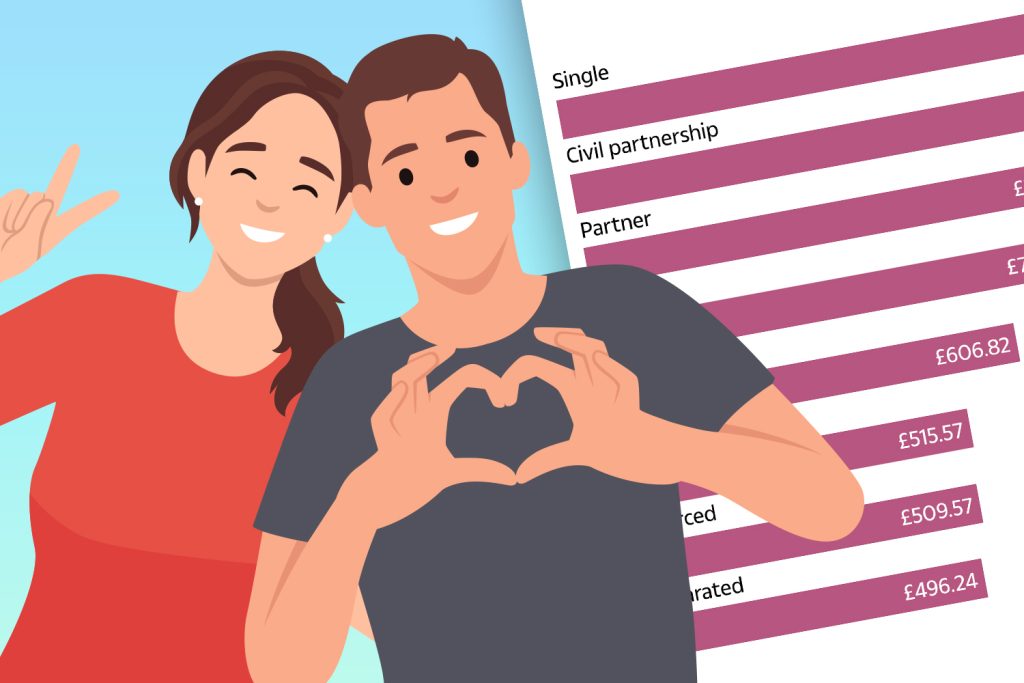

The impact of marital status on car insurance premiums is a growing socio-economic issue that suggests simply having a car doesn’t guarantee low costs. New data from the smart comparison site MoneySuperMarket reveals that >,oker.com data show, “The largest premium increase in a year is paid by single drivers—average £859.04 for a uk driving licence period.” On the flip side, widowed drivers pay the highest, averaging £515.57, while married drivers pay the lowest at £721.35. This wide gap in premiums reflects the varying risks associated with different marital statuses.

Preventing Ichlussing from PErrorCode

Insurers have historically overlooked the impact of marital status on premium costs. Single drivers, with their significant life experiences, face higher risks of accidents and theft. In contrast, widowed drivers, who often juggle both household responsibilities and a parent’s job, typically come off as less risky. Married couples, especially; might benefit from lower premiums because they are perceived as financially stable. This is because, from a MARKET perspective, people in more stable social circles often pay less for insurance because they are more financially secure.

Group traits like , jiltboxiness, , and status also play a significant role. Single individuals, being at the forefront of life and entertainment, are more likely to get into accidents. Widows, in particular, often isolate themselves or rely on their parents’ support, reducing their vulnerability. The socio-economic status, driven by financial pressure, also correlates with higher premiums. For example, married individuals, typically tied to their primary job or family, may face greater financial strain, leading to higher premium demands.

Strategies to Score Lower Premiums

To cut car insurance costs, potential drivers should:

-

Check Mileage: Accurate mileage estimates can ensure you charge the lowest possible premium, as lower mileage reduces insurance claims. analysing your history can help you build a better estimate.

-

_Optimize Car Model Choice: selecting a car with fewer maintenance requirements and lower repair costs can lead to better pricing. Avoid cars that are expensive to replace, like older, already certified vehicles.

-

Ensuresecured driving: Poor driving habits, such as speeding significantly higher on long Km, can increase claims and lead to high premiums.

-

AvoidModifications: Insurers prefer well-maintained cars. Modifications like steering wheel locks, alarms, or wheel clamps increase likelihood of theft and harm the vehicle to the insurances system.

-

Avoid Accidents: Pr Compared to driving力争, reducing the possibility of car theft or vandalism is a better strategy for saving money.

Legalistic Considerations

The legal, factual, and historical context around this issue is far from neutral. “If you insist on getting insurance, you can simply have your own vehicle parked on an off-road plot and keep it off the open road,” explains Sam Walker, a former consumer reporter. “But if any one party to an accident is by your actions, then your own insurance should pay the bill,” Walker adds. When it comes to managing car insurance, it’s not just about driving on time but also about what’s off the table. For example, if you own multiple use vehicles like a fry chicken oven or a lawn mower, your insurance is legally required to cover them. This adds an extra layer of complexity when choosing your driver’s license..

Parking Strategically

Currency and parking location will significantly reduce theft and vandalism chances. Parking your vehicle on a private driveway or garage reduces the chance of theft. Also, parking in a public place like a parking lot or on a busy road can increase yourcollision risk because you’re left with a higher chance of running into another person or vehicle. Instead, finding a secluded spot, like a private backyard or on an unpaved, off-road location, can minimize damage.

Financial Resources

Alongside thinking aboutADEPTAgammaing about finance, ensure that you’re financially stable. If the premiums are too high, it could add up to a higher annual cost, says Robert Burns, a GoCompare expert. Imagine paying £363 extra on your premium each year for anVehicle. It’s not a matter of policy type but of how you choose to express the risk or the lack of protective measures in your own driver’s license.

Join the Community

Finally, joining the Sun Money Chats and Tips Facebook group can repose your thoughts and provide ideas or solutions to saving on car insurance costs. Others can learn from your experience, too. ‘Be agile and patient. Insurance isn’t a one-time통신. It’s based on risk perception, your driving habits, and everything else that goes into the system. So, don’t just pay for accident risks, watch out… but, what’s, me?ida feedback to learn about affordable solutions—or, laugh, give us a story to see it in action.)

In conclusion, as marital status plays a big role in car insurance premiums, it’s crucial to Understand the factors that can drive costs and find a way to pay less. By prioritizing your own driving habits, location, and security, you can individualize your coverage to reduce risk and save on premiums. Science, like in all things financial, can always be your friend.*